28 May 2020

.jpg)

You’re looking to improve your financial situation, but recent volatility has made you question whether now is the right time to invest. 2018 began with increased volatility relative to years past after growing uncertainty on the global stage. Whilst volatility has calmed recently, both politically and financially, it is not a forgone conclusion that volatility won’t soon return. Having said this, it shouldn’t necessarily change the way you invest. To keep your long-term goals on track, it is best to increase diversification in your portfolios. Also, you should seek to take a more risk adjusted approach to investing, such as dollar cost averaging.

Timing the Market and Dollar Cost Averaging

The difficult, if not impossible, task with timing the market involves one’s ability to constantly monitor the movement of the financial markets. Secondly, having the skills to respond to volatility in an effective manner and have enough cash to cover trading costs.

Investors are left asking themselves two questions: How do we avoid the risks of negatively affecting our long-term goals? And what can we do to improve our odds of entering the markets at the best time? The answer to both questions is dollar cost averaging.

Dollar cost averaging is the strategy of spreading out your stock or fund purchases. The ability of buying at regular intervals, and in roughly equal amounts. This strategy avoids having to “time the market” which is an extremely difficult task for even the most sophisticated investor.

Therefore, this makes more sense when used over a long period of time with volatile investments, such as stocks, ETFs or mutual funds. It would make less sense for bonds or money market funds. These securities are available for purchase through regular savings plans, allowing investors to invest on a regular basis. At Winson Capital, the most popular monthly instalments into regular investment plans are $500, $850, and $1,500 per month.

Monthly Contribution Investment

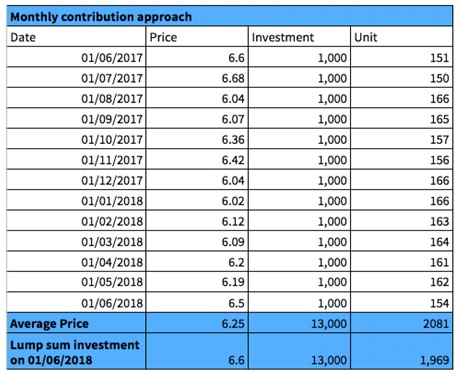

To illustrate the strategy of dollar cost averaging, we have simulated the result of a monthly contribution investment approach. The table shows the comparison with a lump sum approach when making the same investment:

Let’s assume that an investor wanted to increase their exposure to the US equity market. He decides to invest $13,000 in a US stock ETF from June 2017. The investor can either invest the lump sum at the start of the period or choose to make monthly contributions in equal tranches at the start of each month. Over the next year, this should average out the purchasing cost.

By making monthly contributions whilst investing in a volatile and falling market, such as in the early start of 2018, the investor bought more shares at a lower price. He made purchases at $6.25 per share and bought 2,081 shares in total.

If the individual had invested the total amount at the start, they would have paid $6.60 per share and bought 1,969 shares in total. This is equivalent to a discount of 5.4% in price terms and will ultimately boost the performance of the portfolio when markets recover.

However, making regular investments over time in a rising market can also lead to a higher average cost of purchase compared to investing the lump sum at the start.

Build a Strong Portfolio

The fundamental way of constructing a sound portfolio is to consider your goals, risk tolerance and time horizon when deciding on which investments are the most appropriate for you.

With short-term goals, the main priority will be protecting the value of your money whilst for long-term goals, such as retirement, your main priority will be seeing growth within your portfolio.

Building a sound portfolio is a time-consuming process that involves many factors. Here at Winson Capital, we are committed to providing cost-effective investment advice to all our investors. We will take the time to understand your needs to create a portfolio that is best suited for you. Your portfolio will be managed by us throughout your investment time with us . The decision you must make is how much and how frequently you would like to invest.

By choosing dollar cost averaging, you can avoid the cost of committing to a higher sum of money at the beginning of your investment period. Instead, you can build a sound portfolio by investing little and often. Establishing a disciplined and regular investment pattern is a great habit for any saver at any time. When it comes to investing, “slow and steady” wins the race.

TRY WINSON CAPITAL FOR FREE

Simple, efficient and tailored to your profile. Winson Capital financial planning maximises your long-term returns whilst protecting your wealth.

Sign up to Winson Capital now: get access to your investor profile and discover the portfolio that is right for you, free of charge.

TALK TO A WINSON CAPITAL FINANCIAL CONSULTANT

Error: Invalid action URL is detected.