28 May 2020

Keep a cool head as uncertainty strikes, and consider taking advantage of potential opportunities.

Periods of market volatility may cause investors emotional responses. When the markets are as volatile as we have seen lately, it can be natural to feel some anxiety. That is why you and your financial partner have spent time designing a tailor-made financial plan. So that you can prepare for these dips, bounces and recoveries, all whilst still making progress towards your long-term financial goals.

Throughout times of uncertainty, the aim is to maintain focus on those goals. But as you begin planning for market volatility or adjustment, trust your adviser in the planning process revisiting your goals and investments.

The Long-Term Goal

While it may seem unreasonable, part of the approach is to pay less attention to the economy. This is the time to spend more attention to your long-term financial goals. We realize it’s our patterns of behaviour to what the markets do that usually cause the most trouble. For example, stock investors who have actually stayed invested since 2007 and 2013 have almost certainly done well than those who have attempted to try a very volatile market time. Even in an exceptionally-connected age it is complicated.

Consider Your Investments

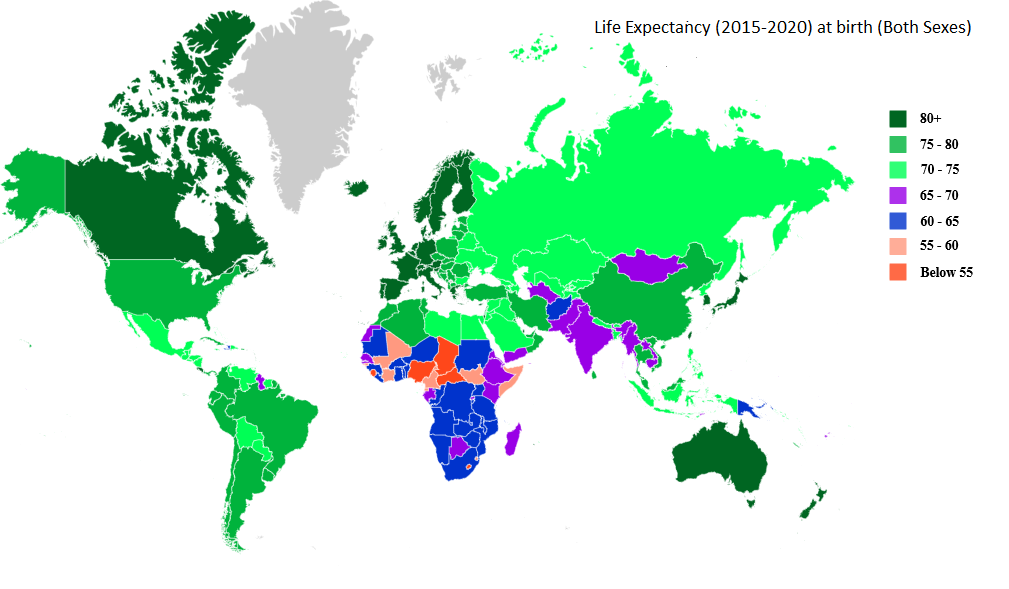

Now seems to be a reasonable time to review your current investments and evaluate whether they are all still suitable for you. Evaluate your investments as a whole to assess whether you are appropriately diversified – in terms of long versus short-term investments, and domestic versus abroad. Consider the current market with your advisor in which volatility is expected to continue and uncertainty regarding the interest rates.

Re-evaluating Your Risk-Appetite

An important part of ensuring you reach your goals always means understanding your level of comfort with market fluctuations. Understanding your risk appetite can provide important perspective for the development of an individual investment strategy. A strategy is designed to help you see the unavoidable ups and downs of the markets.

Your investment portfolio is created to help you meet your financial goals. It is not something you place and forget. It should be constantly reviewed to ensure that it represents shifts in market conditions as well as in your personal life. You also need to regularly monitor the structure to determine the probability of achieving the goals you have set. Even when your investments are on track, or if not, you and your advisor may need to make some changes. As a result, either to your goals or to the investment plan itself.

The Silver Lining

Although declines in the sector are fairly common, the rises have continued to respond traditionally. But to reap from those potential gains, you need to engage, not withdraw. As some of the best days came right after times of steep decline, investors who wanted to pull their money out of equities during those down periods may have avoided some of the biggest gains on the markets. Note also that a fall can present opportunities to purchase quality assets when potentially undervalued. This could encourage you to invest at lower prices in high-quality companies and reap added value.

We are presented with a true testimony to durability when looking at the economy over a fairly long period of time. We learn a lesson in patience, flexibility and commitment by monitoring the overall growth that the market has accomplished.

There is no assurance any investment strategy will be successful. Investing involves risk including the possible loss of capital. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability.

TALK TO A WINSON CAPITAL FINANCIAL CONSULTANT

Error: Invalid action URL is detected.