28 May 2020

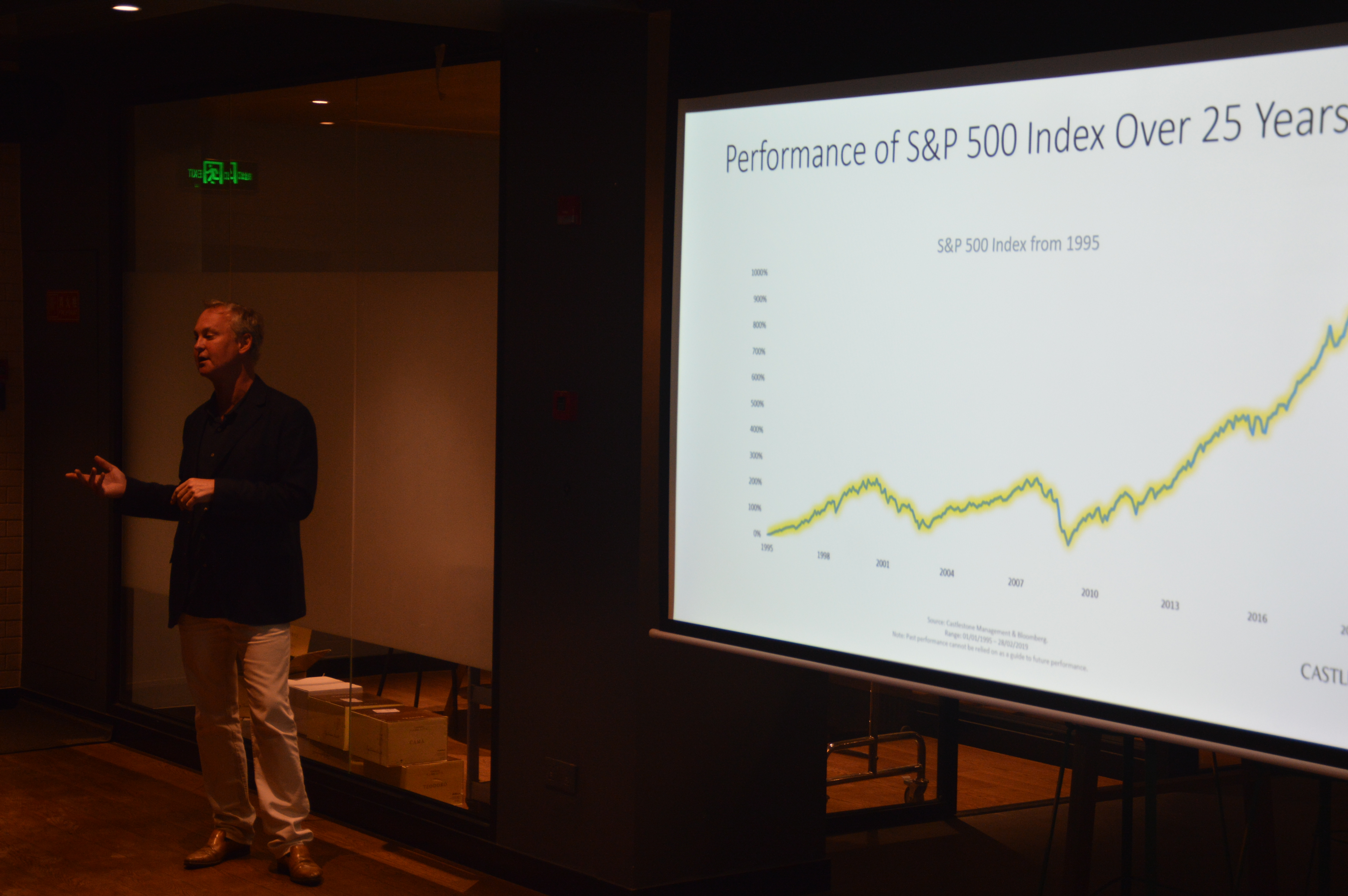

At Winson Capital, we understand the challenges of investing. As always, we aim to share our experience and knowledge with our clients to help them achieve their financial goals. Therefore, on Tuesday, March 12th we partnered with Castlestone Management to deliver a 2018 market roundup and a 2019 market outlook. The presentation by Castlestone was delivered by current CEO Angus Murray, who has a long history in finance. Having headed the International Equity Department of NatWest Markets USA, he resided as the President of Macquarie Bank USA.

Castlestone Management aims to deliver funds that are liquid, completely transparent, not using any leverage and only hold liquid instruments.

Standard & Poor’s 500 Composite Index

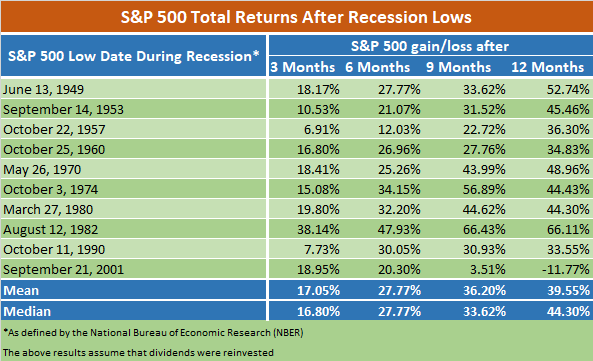

One of the topics covered during the presentation was the history of the Standard & Poor’s 500 Composite Index (S&P 500 Index). This included the performance of the past 25 years. He presented why focusing on long-term investment goals should be especially important during market downturns. As the below table shows, the market has tended to bounce back quickly during the past 10 recessions:

The index generated a 28% mean total return six months after bottoming and 40% a year later. The problem is, no one can predict a market bottom. But investors who maintained a long-term perspective and held on to their investments were able to participate when the market turned positive. As you will see, the S&P 500 rose 17% on average three months after recession low points. Those investors who continued to invest on a regular basis through the recession would have benefited from the subsequent recovery.

Passive vs Active Fund Investing

Passive vs Active fund investing was also discussed. These are the two main fund strategies that can be used to generate a return within investment accounts. Active fund management is the method in which fund managers proactively buy and sell stocks within a fund. This is done as an attempt to outperform a specific index. Passive funds are funds that replicate the performance of a specific index. Because this investment strategy is not proactive, management fees assessed on passive funds are often far lower than actively managed funds.

Professional Advice

The key message received by those that attended the event was to take professional advice. Essentially, this would aid in planning well for the future. There are key times during life when we all need access to capital, such as the funding of education for our children or funding our own retirement. By making sure you save when possible and make sensible investment decisions, you can ensure that reach these key times or financial goals. In other words, you will have the finances to support your hopes and dreams.

At Winson Capital, we help our clients invest and prepare for the future. We help to create financial plans to take you through life’s journey. To discover what we could do for you, get in touch to arrange a meeting with one of our consultants today.

TALK TO A WINSON CAPITAL FINANCIAL CONSULTANT

Error: Invalid action URL is detected.