28 May 2020

When you have a young family, you want them to have the best possible start to life. Therefore, this takes ensuring the best for their future. You do this by trying to provide financial security for them. The trouble is, it’s hard to know whether you’re making the right decisions in the long-run. This becomes a difficult stage, when you’re still trying to work out your own situation.

Before investing with us, one of our clients – Helen, a mum of three, had spent just over 10 years getting low returns from savings she had built up in high-street bank accounts.

Her time was being consumed with her work and raising a family. She didn’t have the time to start learning how to invest properly and manage her own investment portfolio. What she did know was that she needed to take control of her financial situation. Realising her situation, she chose to work with experts who can help her to manage her finances around her busy schedule.

Retirement Security

Helen works hard and saves harder to ensure that she has a secure financial future for her family which is, according to her, having a roof over their head when she retires. She also wants to help her children with their education. Finally, she hopes to get into the real estate market in the future.

Her dream is to retire at the same time as her husband, who is six years older than her. This is earlier than the state pension would usually support, but she hopes that she can devote more time to her family, especially after a long career. They want to be mortgage-free and be able to enjoy the full benefits of retirement.

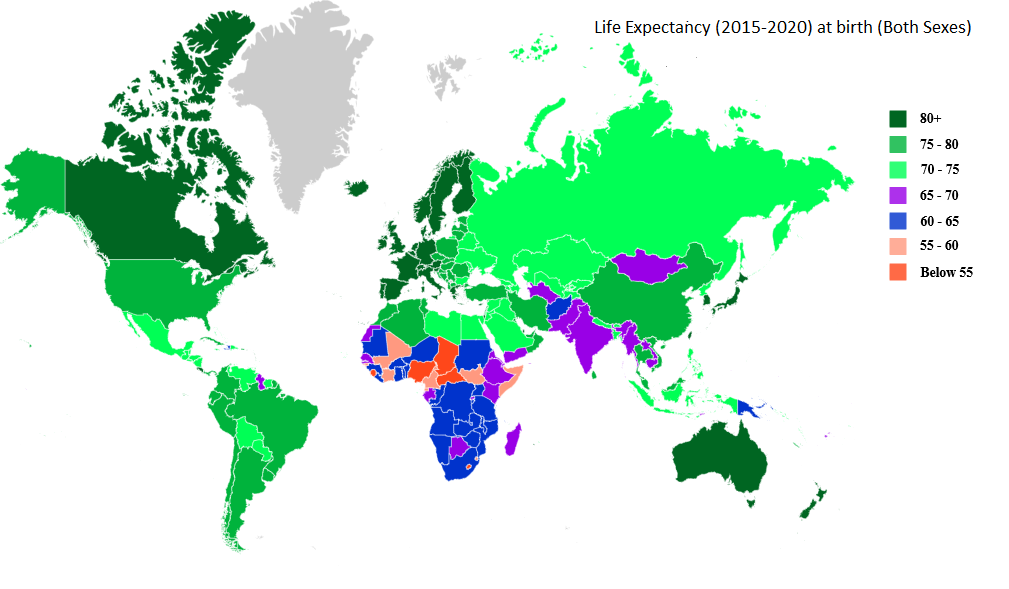

Helen also wants to be able to travel to different parts of the world and see what the world has to offer, all of which can be attained through careful planning and sticking to her pension savings plan.

Utilise Employer Contributions

Helen has two pensions from her previous employer when she worked in the UK. She has a small defined benefit fund and a defined contribution scheme which her employer matched what she contributed. Her employer gives her the option to take a proportion of this as cash in retirement, but she is trying to maximise the possible benefits available to her. She states that it is money she hasn’t seen so she doesn’t think about it much.

As she is getting older, her pension becomes more and more important. She wants to know whether her retirement fund will be enough for the necessities and luxuries she desires and whether the two balance out. She knows there may be a gap between what she wants and what she has but is afraid if she doesn’t start additional planning, it may be too big.

Helen lists her children at the top of her current priorities. She would like to begin a personal savings plan for her retirement, but she is worried that this may adversely affect her current financial situation. These are common concerns we help our clients work through when helping to create our client’s financial plans to give them the future they desire.

After meeting with Helen and discussing her personal situation. We were able to help her set defined goals for her family and future retirement. These goals were then incorporated into a financial plan which we use to help her stay on track. She is now clear on her future and feels much more secure.

Managing the retirement income

Winson Capital has professional consultants who help explore all available options when it comes to saving for retirement. We will provide research when necessary and answer any questions you may have to help you to make informed decisions with regards to what is right for you and your financial goals.

We provide our clients with regulated and personal investment advice. Our goal is to match people with investment portfolios that are designed and managed by professionals to make sure they are in line with our client’s goals. We review investment plans with our clients on a quarterly basis and we’re always available when a client needs us. We aim to ensure that the financial goals our clients have for the future are met.

TRY WINSON CAPITAL FOR FREE

Simple, efficient and tailored to your profile. Winson Capital financial planning maximises your long-term returns whilst protecting your wealth.

Sign up to Winson Capital now: get access to your investor profile and discover the portfolio that is right for you, free of charge.

TALK TO A WINSON CAPITAL FINANCIAL CONSULTANT

Error: Invalid action URL is detected.